The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves.

The Complete Income Tax Guide 2022

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

. Headquarters of Inland Revenue Board Of Malaysia. A household can claim RM400000 tax relief for their non-working spouse. Here are the many ways you can pay for your personal income tax in Malaysia.

Every individual is entitled to RM900000 tax relief. Example of a standard personal income tax calculation in United Kingdom Worldwide Tax Summaries. Tax computation for 202223 for a single individual employee.

Corporate income tax CIT rates. Households with children under the age of 18 years old can claim RM200000 per child. Individual - Sample personal income tax calculation Last reviewed - 27 July 2022.

Our firm also maintains client liaison offices in the United Kingdom United States Italy Russia and. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. For the full list of personal tax reliefs in Malaysia as of the.

First of all you need an Internet banking account with the FPX participating bank. Also discover how much social insurance and Individual Income Tax IIT is payable in your region of China. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

The participating banks are as follows. Valuations of some types of employment income. Starting off would be the Malaysian individual tax relief.

There is also tax saving criteria of RM600000 if the child is. 1 Pay income tax via FPX Services. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer.

The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. Theres even a tax relief for alimony payments. Introduction Individual Income Tax.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. And Vietnam as well as our 8 Asian Alliance partners in Bangladesh Indonesia Malaysia The Philippines and Thailand. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

7 Tips To File Malaysian Income Tax For Beginners

How To Calculate Foreigner S Income Tax In China China Admissions

Individual Income Tax Malaysia Georgiartl

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

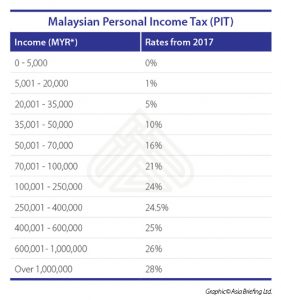

Malaysian Personal Income Tax Pit 1 Asean Business News

Cukai Pendapatan How To File Income Tax In Malaysia

Personal Tax Archives Tax Updates Budget Business News

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Personal Tax Archives Tax Updates Budget Business News

Malaysia Budget 2021 Personal Income Tax Goodies

Malaysian Tax Issues For Expats Activpayroll

Income Tax Malaysia 2019 Calculator Madalynngwf

Individual Income Tax In Malaysia For Expatriates

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets